Vertiv has been ranked by technology analyst firm Omdia as the largest global supplier in the data center cooling market

Vertiv, the global provider of critical digital infrastructure and continuity solutions, has been ranked by technology analyst firm Omdia as the largest global supplier in a data centre cooling market, which continues to undergo changes and innovations. The newly released research highlights that established heat rejection technologies such as direct expansion (DX), chilled water and evaporative cooling continue to dominate. In addition, new technologies, such as forms of liquid cooling, are predicted to grow as data center operators look for ways to further improve efficiency and deal with increasingly power-intensive compute.

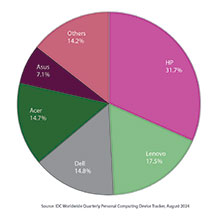

The Omdia paper, Data Center Thermal Management Report 2020, published in late 2020 and based on 2018 and 2019 data, states that Vertiv has a 23.5 percent share of the global data centre cooling market – more than 10 percent higher than its nearest rival. The market for data centre thermal technology is set to increase from $3.3 Billion in 2020 to more than $4.3 Billion in 2024, according to Omdia. Vertiv also leads the global market for perimeter thermal technologies with a 37.5 percent market share which is more than 20 percent higher than the next largest supplier.

“With the rise in demand for heat rejection technologies, growth in edge computing, and increasing rack densities, data centres are increasingly looking for sustainable and energy efficient liquid cooling solutions – immersion and direct-to-chip. Being ranked as one of the leaders in the rapidly evolving cooling market is a testament to Vertiv’s commitment to constantly innovating our digital infrastructure solutions to support these continuously evolving requirements of our customers,” said Raghuveer Singh, Director, Thermal Management, Vertiv India.

In addition to analyzing market position, the report provides insight and intelligence on how data center cooling technology is evolving. Established technologies such as chillers and perimeter cooling will remain a large proportion of the market. According to Omdia, split DX is still the primary form of heat rejection in data center thermal management, but chilled water and direct evaporative heat rejection are gaining momentum. In addition, cloud and colocation service provider momentum has accelerated, driving double-digit growth for air handling units (AHU).

Omdia predicts there will also be strong growth in forms of liquid cooling – immersion and direct-to-chip – that are expected to double between 2020 and 2024. Several factors are contributing to this shift, including increasing chip and server power consumption, edge growth, increasing rack densities, as well as energy efficiency and sustainability requirements.

Lucas Beran, principal analyst for Omdia’s cloud and data center research practice and the report’s author, said, “The data centre thermal management market is on the cusp of an inflection point. Currently, existing air-based thermal products and solutions are driving growth but are limited by their ability to cool 10kW+ rack densities. New technologies, products, and designs are coming to market to help support these high-density deployments and more efficient operations leading to changing market dynamic through 2024”, added Beran.