India’s software market maintains decent pace, revenue to reach $7.6 Billion by end of 2021: IDC

Digital Edge Bureau 16 Jul, 2021 0 comment(s)

According to IDC’s report, the India software market is estimated to reach $7.6 billion by the end of CY21

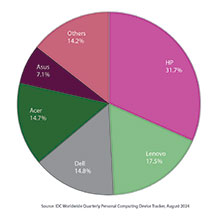

According to IDC Worldwide Semiannual Software Tracker 2H20 (July–December), the India software market is estimated to reach $7.6 billion by the end of CY21. The India software market was pegged at $7.0 billion in 2020, registering a growth of 13.4 percent year-over-year (YoY) compared with that in 2019. India accounted for 17.5 percent share of the overall Asia-Pacific (excluding Japan and China) (APEJC) region software market in 2020. Microsoft, Oracle, and SAP maintained their leadership positions in the India market during the same year.

Shweta Baidya , Senior Research Manager for Software and IT Services at IDC India says, “Although the pandemic had a minor impact on the overall growth of the India software market, it acted as a catalyst for strong growth across some of the software segments as enterprises reevaluated their IT strategies and took concrete steps to move toward digital business models. Digitally matured enterprises were able to smoothly navigate through the crisis and maintain business continuity and operational resilience. However, enterprises with traditional business models charted out new strategies to leverage cloud and digital to stay relevant and consistent. Investment in collaborative platforms, network transformation, and security re-architecture witnessed a spike during the last few quarters”.

IDC classifies the software market into three primary categories: applications, application development and deployment (AD&D), and systems infrastructure (SI) software. Applications contributed 60.4 percent to the overall market revenue, followed by AD&D and SI software with shares of 21.6 percent and 18.0 percent, respectively, in 2020.

As per IDC’s current estimates, engineering applications, collaborative applications, customer relationship management (CRM) applications, enterprise resource management (ERM) applications, and content workflow and management applications are the leading software segments in terms of revenue. The collaborative applications market witnessed the highest growth of 36.7 percent in 2020, followed by artificial intelligence (AI) platforms and system and service management software at 30.9 percent and 24.8 percent, respectively.

“In spite of the adverse impact of the pandemic, India continued to be one of the most resilient markets across the APEJC region. India software market registered a growth of 13.4 percent, which was the highest in the region. Enterprise sentiments improved during the second half of the year and investments were ramped up quickly on digital work models to enable smooth transition to a remote work environment. IT budgets were re-apportioned and allocated in accordance with the increased spending on emerging technologies. Software vendors have been aggressively acquiring customers by supporting them in the digital journey with flexible and scalable options,” adds Baidya.

IDC estimates India’s overall software market to grow at a compound annual growth rate (CAGR) of 11.6 percent from 2020 to 2025. India enterprises will continue to invest in technologies that will help them spur innovation to improve operational efficiency and employee productivity, and in turn, maintain business momentum. IDC expects acceleration in demand for technologies, such as robotic process automation (RPA) software, conferencing and collaborative applications, AI platforms, digital commerce applications, and IT service management (ITSM) software, among others. Additionally, cloud is also becoming one of the critical elements of enterprises’ digital strategy. IDC expects the contribution of platform-as-a-service (PaaS) and software-as-a-service (SaaS) markets to the overall software market to increase from 36.8 percent in 2020 to 57.1 percent in 2025.