India’s leading gold loan NBFC Muthoot Finance introduces AI enabled virtual assistant Mattu

Digital Edge Bureau 11 Oct, 2021 0 comment(s)

Muthoot Finance has tied up with Senseforth.ai for introducing Mattu, an AI-powered virtual assistant

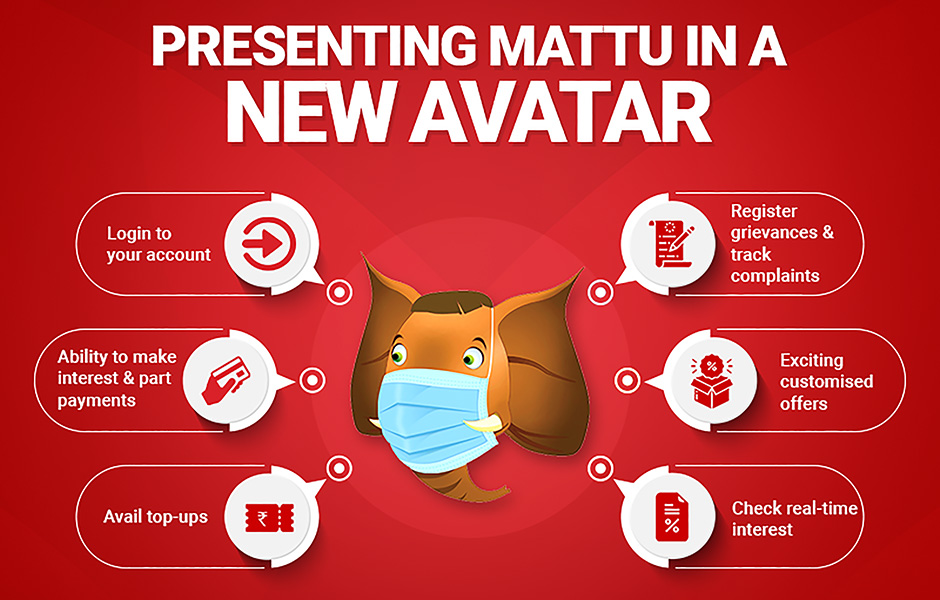

Muthoot Finance, one of India’s leading gold loan NBFC, has joined hands with Senseforth.ai – a leader in conversational AI technology, for launching Mattu – an AI-powered virtual assistant. Available on the website and mobile app, the intelligent assistant enables users to apply for various kinds of loans, address concerns, and perform transactions like checking account balance, paying gold loan interest, availing loan top-ups, making part payments and much more.

“The launch of a revamped and turbo-charged Mattu marks the beginning of a new chapter for us. This AI-powered virtual assistant offers various customer-friendly features like multi-lingual support, voice search capability, and can handle more than 250 frequently asked questions. Besides, if a user wants to speak with our customer service representative, they can do so via the virtual assistant. This is great customer convenience in current times”, says Alexander George Muthoot, Deputy Managing Director, Virtual Assistant, The Muthoot Group.

Eapen Alexander Muthoot, Executive Director, The Muthoot Group, views, “As a leading NBFC in the country, technological innovations are at the core of our customer-centric approach. Mattu opens up another secure communication channel with our customers and offers a plethora of intuitive features and benefits. This is an excellent value addition for our customers and also demonstrates our commitment to the digital-first agenda at the company.”

Shridhar Marri, CEO & Co-founder of Senseforth.ai, says, “The modern day customer expects their needs to be fulfilled within seconds, without having to browse the website or visiting a branch. The launch of Mattu would eliminate buyer friction and ensure that customers of Muthoot Finance have instant access to key services on a channel of their choice.”

With the launch of this unique AI-powered Chatbot, Muthoot Finance is fast emerging as a leading lender that is persistently offering a range of tailor-made, technology powered services bringing convenience to its customers. Recently Muthoot Finance had also launched a facility by which its gold loan customers can repay their loan or make interest payments through PayTM, Google Pay and PhonePe. There are also exciting cash back offers for online interest payments. Muthoot Finance Gold Loan customers can also avail loan top-ups in just a few clicks using WhatsApp. They can also get a gold loan from the convenience of their home through Muthoot Finance Gold Loan@Home service.