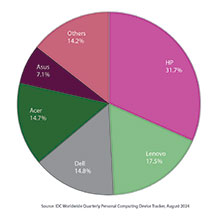

HP Enterprise has maintained its market domination in the x86 server space in India

In its Worldwide Quarterly Server Tracker, Q2 2020, IDC reports that India witnessed a year-on-year (YoY) decline of 22.3 percent in terms of vendor revenue to reach $272.0 million in Q2 2020 versus $350.2 million in Q2 2019.

But, the highlight of the IDC report is that HP Enterprise notches up 30.3 percent

market share with a revenue of $70.6 Million in the x86 server space with Dell capturing 22.9 percent market share realizing a revenue of $53.4 million. At number three comes Cisco Systems with 10.0 percent market-share and a revenue of $23.2 Million.

Lenovo takes up the fourth slot accounting for a market-share of 7.2 percent and a revenue of $16.7 Million. This is to be noted that the key wins for HPE came from telecom vendors, IT and ITeS companies, high-tech semiconductor manufacturing companies, and banking organizations.

The x86 server market accounts for 85.6 percent of overall server market in terms of revenue. The contribution to x86 server market continues to come from the professional services, telecommunications, followed by manufacturing and banking verticals. For the telecommunications vertical, spending was observed from several on-going projects and network expansion projects.

For the banking sector, spending from nationalized and private banks were focused on digital transformation, business continuity, and providing robust banking platforms to the customers. Manufacturing spend was largely driven by global players for their research related projects during Q2 2020. While, the non-x86 server market grew YoY by 10.3 percent to reach $39.1 million revenue, in Q2 2020.