In the just released Worldwide Quarterly Personal Computing Device Tracker by IDC, this has been revealed that India’s traditional PC market – including desktops, notebooks and workstations – shipped 3.39 million units in 2Q2024, up 7.1 percent year-over-year (YoY). This has further been highlighted that all the three personal computing product – desktop, notebook and workstation – grew YoY by 5.9 percent, 7.4 percent and 12.4 percent respectively.

In the just released Worldwide Quarterly Personal Computing Device Tracker by IDC, this has been revealed that India’s traditional PC market – including desktops, notebooks and workstations – shipped 3.39 million units in 2Q2024, up 7.1 percent year-over-year (YoY). This has further been highlighted that all the three personal computing product – desktop, notebook and workstation – grew YoY by 5.9 percent, 7.4 percent and 12.4 percent respectively.

According to the latest data by IDC, the consumer segment In 2Q2024 surged by 11.2 percent YoY as both online and offline channels saw good demand. The e-tail channel grew by a healthy 22.4 percent YoY. The commercial segment grew by 3.5 percent YoY fueled by an increased demand in the SMB and LB segments which grew by 12.4 percent YoY and 33.1 percent YoY respectively.

“This is the fourth consecutive quarter of YoY growth for the consumer segment. Vendors kickstarted the back-to-school/college campaigns, and good demand was seen in the e-tail channel as well during online sales. Vendors stocked the channel to prepare for the independence day sales, which gave a healthy growth in consumer PC shipments,” Bharath Shenoy, Research Manager, IDC India & South Asia.

Navkendar Singh, Associate Vice President, Devices Research, IDC India, South Asia & ANZ, said, “AI PCs may not bring significant consumer demand in the near term, it is likely to make gamers and content creators consider an AI PC in the medium term. AI PCs will also drive refresh commercial orders from 3Q2024 onwards.”

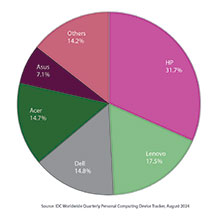

Top 5 Companies

HP led the charts in both commercial and consumer segments with shares of 33.5 percent and 29.7 percent, respectively. HP also led the notebook category with a share of 34.4 percent driven by increased demand for consumer notebooks and fulfillment of some key enterprise orders.

On the other hand, Lenovo stood second as its shipments grew in both consumer and commercial segments by 32.7 percent YoY and 6.3 percent YoY, respectively. Lenovo fared well in the SMB segment, growing by 16.5 percent YoY. Good demand on e-tail channel and continued push in the SMB segment with a good mix of AMD-powered devices in the channel helped Lenovo’s improved performance.

Dell Technologies stood third as it struggled in the commercial desktop category, which declined by 15.9 percent YoY due to continued pricing pressure from its peers in government and enterprise orders; however, it witnessed a 6.4% YoY growth in the consumer segment. Dell had a good back-to-school/college campaign and managed good traction in offline channels.

Acer Group stood fourth but with a healthy growth of 38.3 percent YoY in 2Q2024. It led the desktop category with a 27.6 percent share. Acer managed to fulfill some key government and BFSI orders, which helped it show a strong position in the commercial desktop category. The continued aggressive push during e-tail sales helped it in the consumer segment.

Asus held the fifth position as it witnessed a growth of 5.4 percent YoY. Despite the base being low, Asus witnessed a significant 131.7 percent YoY growth in the commercial segment. Growing focus on the commercial segment and continued expansion in offline presence has been driving its performance.