As per IDC APAC’s Quarterly Personal Computing Device Tracker, Q2-2019, the Indian PC market registered growth of 49.2 percent (with a shipment of 3.4 million units)

The India traditional PC market (inclusive of desktop, notebook, workstation) shipped 3.4 million units, recording a solid 49.2 percent year-on-year (YOY) growth, according to IDC’s Asia/Pacific Quarterly Personal Computing Device Tracker, 2Q19. This growth was mainly due to commercial segment driven by ELCOT (Electronics Corporation of Tamil Nadu) education deal fulfilment under which Tamil Nadu Government plans to distribute around 1.5 million laptops to students.

Bharath Shenoy, Market Analyst, PC, IDC India, says, “The model code of conduct impacted the first two months of the quarter, but things picked up post-election. Strong performance from the SMB sector and corporates because of Windows 10 refresh coupled with a strong performance from the BFSI sector and increased global refresh orders helped commercial segment stay positive”.

The notebook category grew by 81 percent YoY contributing 74.3 percent of the overall India traditional PC market. This growth is again attributed to the ELCOT deal. Ultraslim category, with a share of 21.1 percent of the total notebook’s category, grew by 92.7 percent.

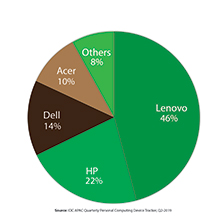

Lenovo led the India traditional PC market in 2Q19 with overall market share of 46.2 percent. It saw a YoY overall growth of 283 percent mainly backed by ELCOT shipment in the commercial segment. Outside ELCOT, it fared well in education and BFSI segments. The vendor, however, saw a YoY decline of 14 percent in the consumer segment. Owing to slow response to “back to school” campaigns, Lenovo, just like other vendors struggled to fare well in the consumer segment.

While, despite posting strong quarter across consumer as well as commercial segments, HP Inc. slipped to second spot in 2Q19. It had an overall market share of 22.4 percent in 2Q19 though it observed a YoY growth of 5.9 percent. Despite challenges in consumer segment, the vendor delivered strong performance in the gaming segment. HP has started to focus more on the e-tail channel and expects it to drive its gaming notebook sales. Owing to its increased focus on the SMB segment, HP registered a strong growth of 17 percent in a commercial segment on a YoY basis.

On the other hand, Dell India had a relatively weak quarter as its T2/T3 channel partners faced credit issues. The vendor slipped to the third spot as its share fell to 14.2 percent in 2Q19. The vendor had a YoY decline of 10.1 percent. It had a weak consumer quarter where it witnessed a YoY dip of 40.4 percent. However, it managed to clock 13 percent growth in the commercial segment which helped the vendor regain some ground lost in the consumer market. It fared well on BFSI and IT/ITES segments which led to relatively better commercial performance.

The consumer PC market declined by 14 percent YoY. The expected revival post-elections remained subpar and the overall pessimism of previous few quarters continued in Q2. The footfalls in LFR’s and branded shops remained weak. While, the online channel picked up towards the end of the quarter. Also, the consumer response to “back to school” campaigns was less than expected. Dell channel partners faced credit issues leading to inventory correction, thereby impacting fresh consumer shipments. The Gaming PC segment, however, grew by 41.1 percent and continues to be one bright spot in the struggling consumer PC market.

The overall commercial PC market grew by 108 percent in 2Q19; taking the total shipments to 2.43 million units. This growth was driven by a single 1.11 million units ELCOT deal. Even outside ELCOT, the commercial market did well with a growth rate of 12.6 percent YoY.

India PC Market Forecast

IDC anticipates the overall traditional India PC market to decline in 3Q19 over last quarter since a major portion of ELCOT deal has been reported in Q2. The commercial market outside ELCOT is also expected to be strong as the government and education projects are expected to materialize.

Nishant Bansal, Senior Research Manager, IPDS & PC, IDC India, says,”Fresh demand by medium and large enterprises is expected to continue. Global refresh orders are also expected to continue among the top brands as Windows 10 refresh would start gaining momentum. The consumer market is expected to pick up largely because of multiple rounds of online sales commencing with Independence Day in August leading up to Diwali in October. Instant cashback and EMI options will drive consumer purchases”.