Nucleus Software registers Rs. 202.2 Crore in revenue for Q2 FY 2024-25

Digital Edge Bureau 12 Nov, 2024 0 comment(s)

Vishnu R. Dusad, Co-founder & Managing Director, Nucleus Software

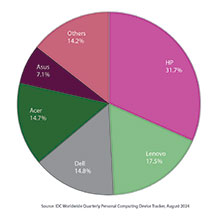

Nucleus Software, the leading banking software solution provider, has registered a consolidated revenue accrual of Rs. 202.2 Crore for Q2 FY 2024-25 ended on September 30, 2024 as against Rs. 205.3 Crore in the same quarter in FY 2023-24. The PAT on a consolidated basis was at Rs. 33.1 Crore, as against Rs. 44.6 Crore in Q2 of FY 2023-24.

The revenue on a standalone basis is at Rs. 185.3 Crore for Q2 FY 2024-25 as against Rs. 189.4 Crore in Q2 of FY 2023-24. The PAT in Q2 of FY 2024- 25 stood at Rs. 36.5 Crore on a standalone basis as against Rs. 42.1 Crore in Q2 of FY 2023-24. The basic EPS on standalone basis during this period was Rs. 13.6 as against Rs. 15.7 in FY 2023-24.

Vishnu R. Dusad, Co-founder & Managing Director, Nucleus Software, says, “At Nucleus Software, we remain committed to delivering resilient and consistent performance, even in digitally dynamic market conditions.”

“We consider this quarter as a foundation for our future ambitions. We will continue to adapt with the evolving needs of end customers, with a focus on innovative digital solutions for sustainable growth,” adds Dusad.

Nucleus Software continues to drive impactful innovation, ensuring that our platforms meet the needs of the evolving technology landscape. Alongside advancing our flagship solutions, FinnOne Neo and FinnAxia, we are deeply committed to fostering financial inclusivity—a vision of Viksit Bharat.

“As we conclude Q2 2024, we remain focused on our strategic goals and the ongoing enhancement of our solutions. Our result reflect a balanced performance amid market complexities. Nucleus Software will continue focusing on delivering advanced and robust technology for the BFSI sector, emphasizing significant value and unique customer-centric solutions,” said Parag Bhise, CEO, Nucleus Software.

Nucleus Software is committed to staying ahead of industry trends, with substantial investments in research and development. Harnessing AI-powered insights, advanced cybersecurity, and API-led seamless integration, the company’s lending and transaction banking platforms enable financial institutions to provide hyper-personalized services at scale.